Seven months after a historic settlement between Goldman Sachs and a group of women who sued the financial giant for pay discrimination, not much seems to have changed on Wall Street. Serious challenges persist for women who work in finance. Women in North America held only 21% of senior leadership jobs in financial services in 2022 and of 15 industries in a recent survey, finance and insurance had the biggest average pay gaps. I wrote about these issues today for Capital & Main.

Susan Antilla

Journalist and Author

Regulators open probes, Warren Buffett dumps stock as claims of abuse and fraud mount vs a top Globe Life agency

In the months since Insider published my investigation into alleged sexual assault, drug use, and customer abuses at a major insurance agency based in Wexford, Pa., insurance regulators showed up unannounced at the company’s headquarters and Warren Buffett has dumped more than half of his investment in the agency’s parent — Globe Life. Here’s a link to my story today.

The Most Shocking Sexual Harassment Case Ever: Interview With Reporter Susan Antilla

I was recently interviewed by Mark Carey about my reporting on Renee Zinsky’s sexual harassment case and its ramifications. You can listen to the podcast here.

Fallout for Globe Life, Arias Organization, after Insider.com article

Two weeks after Insider.com published my story about sexual assault, drug use and violence at a top insurance agency of Globe Life American Income Division, the story has been cited in multiple court filings in a civil suit. A spokesperson for the Texas Rangers, the Major League Baseball team that plays on Globe Life Field, said the Rangers are “aware” of the allegations against Globe’s Arias Organization. The Feb. 24 story depicted a toxic workplace at Arias Organization, based in Wexford, Pennsylvania.

Two law firms are looking into the possibility of shareholder lawsuits against Globe Life, a company traded on the New York Stock Exchange. And Renee Zinsky, a former Arias agent and the plaintiff in the explosive sexual-harassment and sexual assault lawsuit, said more than a dozen potential witnesses contacted her about supporting her case. You can read the story here.

Inside the tawdry, drug-fueled world of insurance juggernaut Arias Organization

Women at Arias Organization, a top life insurance agency based in the suburbs of Pittsburgh, say they were fed date rape drugs, compared to dog puke, and forced to watch a boss masturbate. I worked for months on this project for Insider.com, ever-more incredulous as each reporting week went by. I have written about gender discrimination for nearly 30 years. This, by far, is the worst treatment of women in the workplace that I’ve ever seen.

Arias is a star agency under the umbrella of Globe Life Inc., a New York Stock Exchange-traded company that is in the portfolio of Warren Buffett. The agency is known by several names, including Arias Agencies, the Arias Organization and Globe Life American Income Division: Arias Organization. You can read my story here.

Goldman Sachs Kept the Lid On Sensitive Sex Bias Filings For Years. Until Now.

Over 17 long years — starting long before the #MeToo movement galvanized the nation — one of the most powerful banks in the country has been able to keep the lid on many embarrassing details of a high-profile under discrimination case. A day of reckoning could be on the horizon, though, with a recent agreement between Goldman Sachs and a group of women suing the firm in that case to unseal their allegations of harassment and discrimination. I wrote about the case today for Capital & Main.

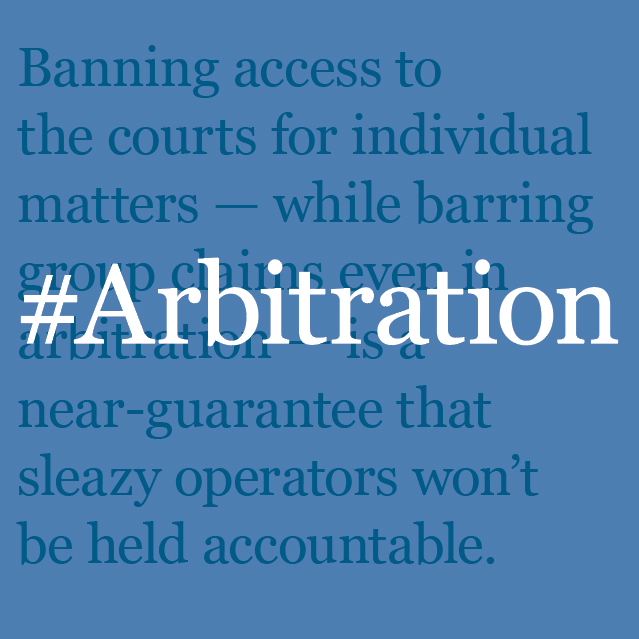

Forced Arbitration Is Making It Harder for Low-Wage Workers to Seek Justice

More than 60 million U.S. workers have no choice but to use closed-door arbitration — instead of the public courts — if they have a dispute with their employer. I looked into the ways that so-called “forced arbitration” harms low-wage workers who are seeking justice. Here’s my article today in Capital & Main.

To Review Its Mandatory Arbitration Policy, Goldman Sachs Hires Jeffrey Epstein’s Law Firm

Goldman Sachs & Co. is among the 50+ percent of U.S. companies that have forced employees into contracts that require them to use closed-door arbitration — not the public courts — in the event of a dispute. So-called “mandatory arbitration” is one of the greatest scams ever by Corporate America and helps keep racists, sexual harassers and other miscreant bosses out of the headlines and entrenched in their jobs.

So it shouldn’t have come as a huge surprise when, earlier this week, Goldman said it had hired a law firm to review the impact of mandatory arbitration on its employees and that arbitration was working just fine! Which indeed it is, for Goldman. What was a surprise was news that the law firm that did the review was the same one that sexual predatorJeffrey Epstein used. I wrote about it today in The American Prospect.